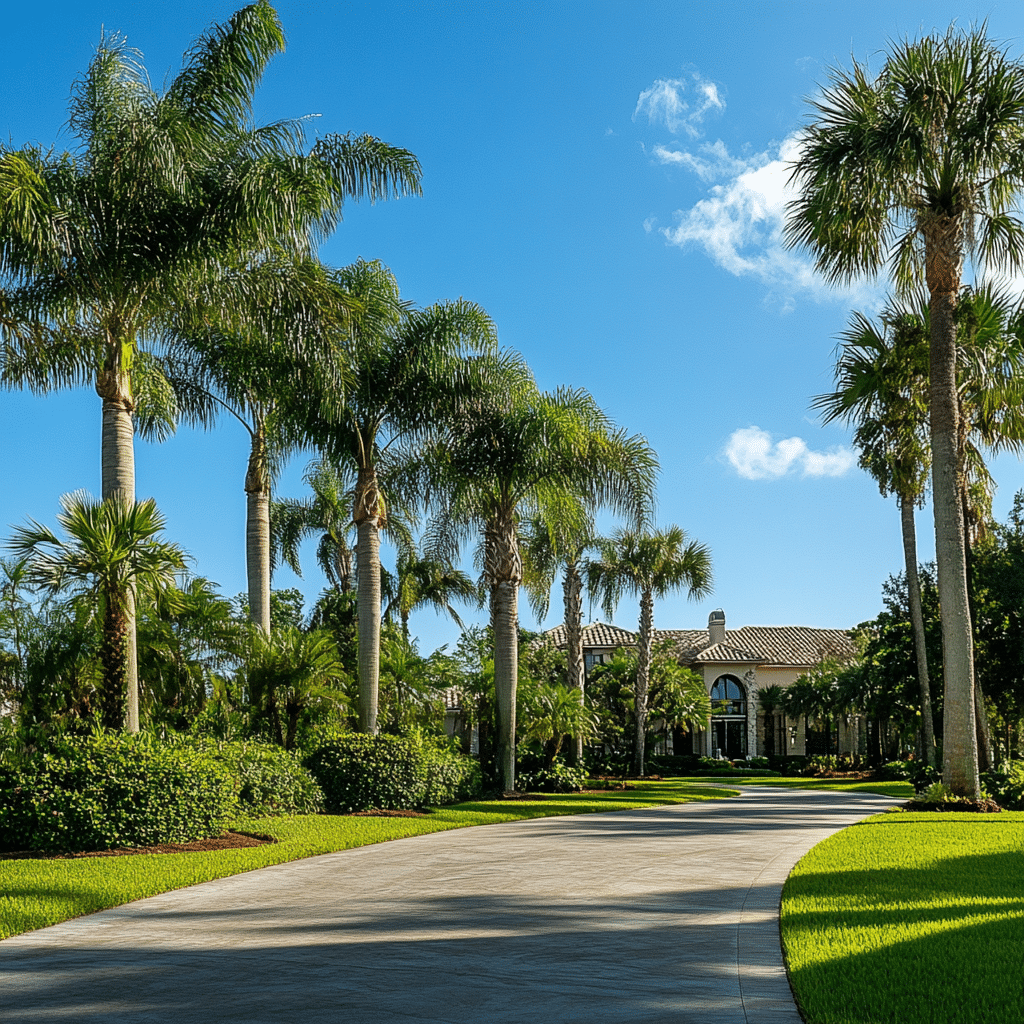

If you’re a homeowner or aspiring property investor, understanding the Indian River County Property Appraiser’s role is crucial for making savvy financial decisions. This office ensures property values reflect the market accurately, and its assessments influence property taxes and local funding. With public services relying heavily on these assessments, this information affects everyone, from homeowners to renters, in Indian River County and beyond. In this article, we’ll spill the beans on the Indian River County Property Appraiser, including secrets that could save you money and comparisons with nearby counties like Brevard, Citrus, Seminole, and Broward.

1. Understanding the Role of the Indian River County Property Appraiser

The Indian River County Property Appraiser is responsible for appraising all types of property within the county to establish their market value. This process ensures that property taxes are fairly assessed, affecting everything from schools to road maintenance. Accurate assessments are vital for the local economy, as they directly influence revenue generation for essential public services.

When you compare this office to others, like the Brevard County Tax Collector or the Citrus County Property Appraiser, it’s clear they all share similar goals. However, differences in assessment methodologies and local regulations create a unique landscape across counties. For instance, the Seminole County Property Appraiser may have different approaches than those in Broward County. Knowing these nuances can help property owners strategize their finances effectively.

The Importance of Accurate Assessments

Accurate property assessments keep the tax rates fair and financially healthy for local governments. Without them, public services would either suffer from budget shortfalls or burden residents with unreasonable taxes. Frequent updates and refined methodologies are essential for staying current with market trends. The Indian River County Property Appraiser draws on a variety of data sources to ensure property values accurately reflect the local market.

2. Top 5 Secrets of the Indian River County Property Appraiser That Could Save You Money

Stay Informed and Empowered

These secrets can lead to significant savings. Ignoring them could mean leaving money on the table. Equip yourself with insights and don’t hesitate to advocate for your financial well-being.

3. How the Indian River County Property Appraiser Compares with Surrounding Counties

The methodologies employed by the Indian River County Property Appraiser differ notably from those used by neighboring counties like Brevard and Citrus. For instance, while Indian River relies heavily on comparative market analysis, the Broward County Property Appraiser may apply more weight to income-producing properties.

Understanding Methodological Differences

In Brevard County, the focus may shift slightly towards a more detailed income approach, which is beneficial for investors but can lead to higher taxes for residential homeowners. Conversely, properties in Seminole County might be affected by stricter zoning laws that limit how properties can be utilized, affecting their appraisal values.

Real-World Implications

For example, a home in Indian River County assessed at $250,000 might fetch a very different amount in Seminole County due to these assessment techniques. As a homeowner, understand where your property fits in this range to better plan your finances.

4. The Impact of Technology on Property Appraisals in Florida

As technology evolves, so does the landscape of property appraisals in Florida. The Indian River County Property Appraiser is now leveraging tools like drone surveys and GIS mapping for enhanced accuracy in property assessments. These innovations not only streamline the assessment process but also improve transparency.

Utilizing Online Property Databases

These advancements enable homeowners to access online property databases, empowering them to make informed decisions. When comparing property values and trends, data-driven insights from the appraiser’s office are invaluable.

A County-Wide Comparison

When looking at tech adoption in Indian River compared to counties like Brevard and Broward, it’s clear that Indian River is making strides. Counties that embrace advanced technology often experience more agile responses to the changing property market, enhancing community engagement and satisfaction overall.

5. Navigating the Property Tax Landscape: Strategies for Homeowners

Make understanding your property tax liabilities a priority. Start by reviewing your property assessment and determining if you’re eligible for exemptions. Familiarize yourself with the important paperwork and resources available to simplify this process.

Engaging with Tax Collector Offices

It’s beneficial to connect with county offices, such as the Brevard County Tax Collector. They can offer strategies for managing your taxes efficiently and clarifying any questions regarding tax liens that may arise.

Preparing for Future Assessments

Take proactive steps well before assessment notices arrive. Create a clear plan for budgeting, investing wisely in property upgrades, and engaging with the property appraiser’s office. This strategy will help position you favorably during assessments and strengthen your financial planning.

Innovative Insights into Future Property Trends in Indian River County

Looking ahead, several trends will inevitably impact property values in Indian River County. Urbanization, demographic shifts, and changes in local legislation will all play pivotal roles.

Predictions and Potential Outcomes

Increased population density may shift demands in the real estate market, leading to rising property values. Legislative changes around property tax laws, as hinted by recent conversations in the Indian River County Property Appraiser’s office, may also influence future assessments and market dynamics.

Capitalizing on Change

The potential for future growth offers excellent opportunities for savvy property owners. By keeping lines of communication open with the Indian River County Property Appraiser, you can remain informed and ready to act when the time comes.

By delving into these strategies and insights regarding the Indian River County Property Appraiser and surrounding counties, you’re positioned to make informed decisions that can enhance your financial health. This knowledge does not only enrich your understanding of property ownership but also empowers you to navigate the twists and turns of real estate with confidence. Whether it’s maximizing exemptions or understanding future trends, the secret to successful property ownership is just a click away.

For those looking to stay trendy this season, while you’re diving into financial insights, why not check out the latest in espadrille Sandals or catch up on Jaden Smith Movies during your downtime? Whether you’re sipping some good red wine or relaxing with an episode from Outlander Season 6, remember: a well-informed homeowner is always ahead of the game.

Indian River County Property Appraiser Secrets You Must Know

Fun Facts That Will Surprise You

Did you know the Indian River County Property Appraiser’s office manages nearly 80,000 parcels of land? That’s right! It’s a massive task, much like trying to figure out the best strategy for Fortnite No Fill. You’ve got to be on your toes and prepared for anything! Plus, the county’s budget relies heavily on property tax assessments, which means everything they do makes a difference in community funding. Speaking of communities, just like passionate fans of the Fluminense Football club rally together for their team, homeowners are encouraged to stay informed about property values. Their input helps ensure fair assessments that benefit everyone in Indian River County!

Now, let’s dig a bit deeper. The office uses advanced technology to keep track of properties. From aerial photography to 3D modeling, they’re working hard behind the scenes. Think of it as being a Hunter For Hunter—always on the lookout for the best tactics to find valuable information! Additionally, you might find it interesting that the county appraiser’s website offers various resources to help the public understand property taxes better. This initiative is like savoring a fine Buffalo Trace bourbon, where every sip deepens your appreciation for the flavors.

It’s equally important to keep track of property values since they can change due to various factors—the economy, market demands, or even local growth. In other words, staying informed helps property owners avoid surprises, which can sneak up on you like rumors from the Cotizen Free Press! Ultimately, knowing these secrets about property assessment not only empowers homeowners but also promotes a balanced community.

In summary, understanding Indian River County’s property appraisal nuances offers more than just knowledge; it can enhance your property strategy. So, next time you pay a visit or check in on those property records, remember all these fascinating bits!