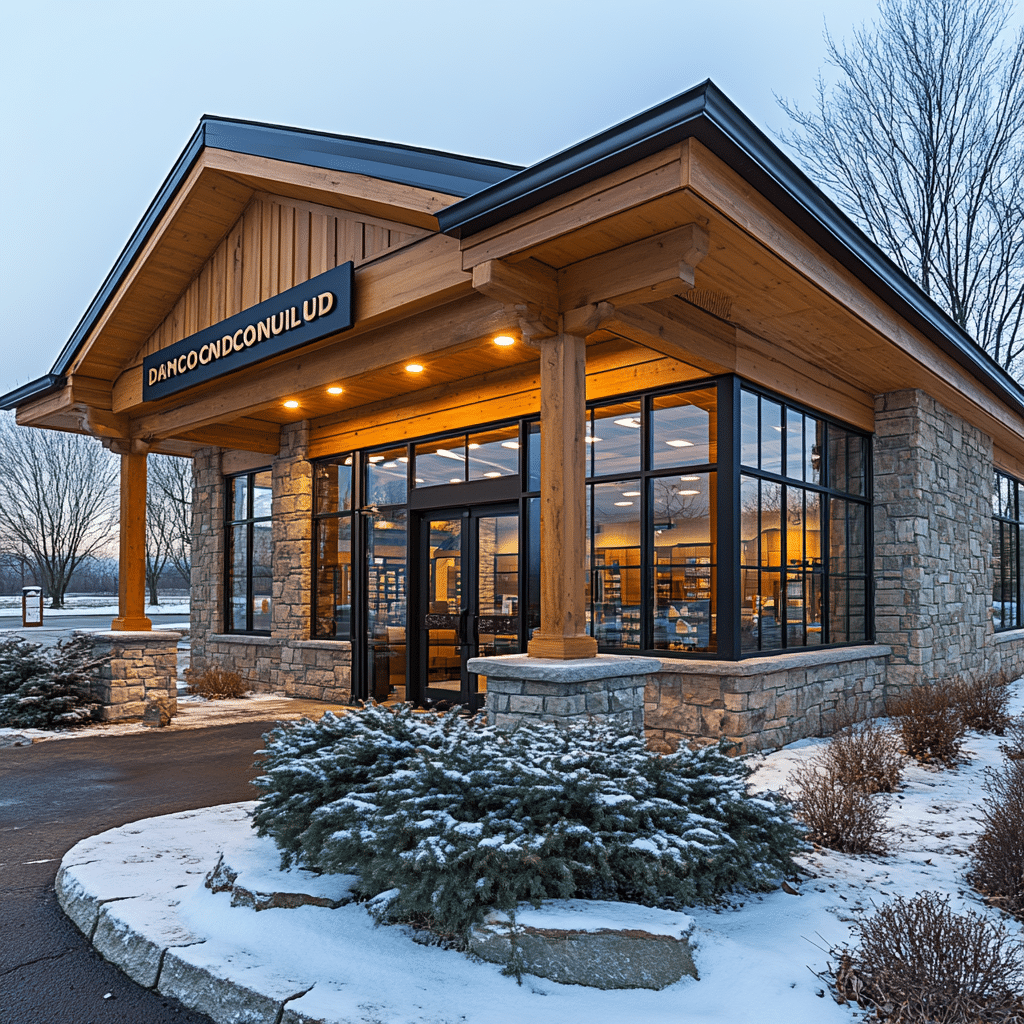

If you’re looking to boost your financial wellness, Dupaco Community Credit Union (DCCU) is here to deliver. Founded by a group of ten employees from the Dubuque Packing Company with just a $5 stake and a $123.20 loan, Dupaco has transformed lives since its inception. Picturesque and community-driven, this credit union reflects a heartfelt commitment to its members, offering a range of membership benefits that can truly enhance your financial journey. Let’s dive into what makes DCCU a premier choice for anyone seeking financial growth and stability.

The Top 7 Benefits of Joining Dupaco Community Credit Union

Joining Dupaco Community Credit Union can greatly improve your financial future. Here are the top seven benefits that make DCCU stand out:

Dupaco offers competitive interest rates across the board. As of 2024, their auto loans start at just 3.25% APR. This is a significant leap compared to bigger banks, like Wells Fargo, where rates hover around 4.5%. When you’re looking to finance a new ride, Dupaco’s rates feel like a breath of fresh air!

Customer service is at the heart of DCCU’s philosophy. Unlike large financial institutions where you might feel like just another number, Dupaco prides itself on personalized service. Their knowledgeable financial advisors are dedicated to understanding your unique needs, making tailored recommendations that work for you. It’s like having a personal fitness trainer, but for your finances!

Financial clarity is crucial, and Dupaco excels here. DCCU keeps fees low, especially when compared to competitors like Merrimack Valley Credit Union, known for its hidden fees. At DCCU, you’ll find no monthly charges on your standard checking accounts—just straightforward banking that keeps your money where it belongs: in your pocket!

In our tech-savvy world, a seamless online banking experience is a must. DCCU offers an intuitive mobile app that allows you to deposit checks and pay bills with ease. This stands in stark contrast to Point Breeze Credit Union, where members have reported challenges navigating the online interface. With Dupaco, banking feels easy and accessible—just how it should be!

Dupaco isn’t just about banking; it’s about community. Through initiatives like the Dupaco Community Fund, they actively support local non-profits focusing on education and financial literacy. As a member, you’re not just taking care of yourself; you’re helping your community thrive. It’s a win-win for everyone involved!

Dupaco delivers an array of financial wellness programs designed to empower members. Workshops covering budgeting, saving, and investing equip you with essential tools for financial management. This educational approach stands out from competitors like Merrimack Valley, who fall short in providing similar resources. At Dupaco, you’ll feel confident tackling your financial future.

The DCCU cash-back program rewards your everyday spending. For instance, you can earn up to 2% cash back on eligible purchases each month, giving you a reason to celebrate mundane transactions! Who doesn’t love getting money back on their daily expenses?

Comparing Dupaco Community Credit Union with Merrimack Valley Credit Union and Point Breeze Credit Union

When selecting a credit union, it’s wise to compare your options. Here’s how DCCU aligns—and excels—against Merrimack Valley Credit Union and Point Breeze Credit Union:

Elevating Your Financial Journey with Dupaco Community Credit Union

Joining Dupaco Community Credit Union is more than just banking; it’s committing to your financial growth and your community’s well-being. With a people-first approach and an array of beneficial programs, DCCU is shaping what modern credit unions can provide in 2024. Whether you’re after loans, savings options, or a way to make a genuine impact, Dupaco is the perfect solution.

So, why wait? Getting started is easy! To become a member, all you need to do is open a savings account with $25 or more. Yes, you read that right! Even if life takes you away from the area, as long as that little safety net remains in your savings, you can enjoy all the perks that Dupaco has to offer, staying connected to a community that truly cares.

You’re not just a number with Dupaco Community Credit Union; you’re part of a thriving family. So, what are you waiting for? Take the leap into a better financial future today! And who knows, you might even discover the immeasurable benefits of being a part of this fantastic community. Embrace the journey, and make the most of your experiences—just like you would in any fitness endeavor!

Fun Trivia and Interesting Facts about Dupaco Community Credit Union

A Community-Loving Credit Union

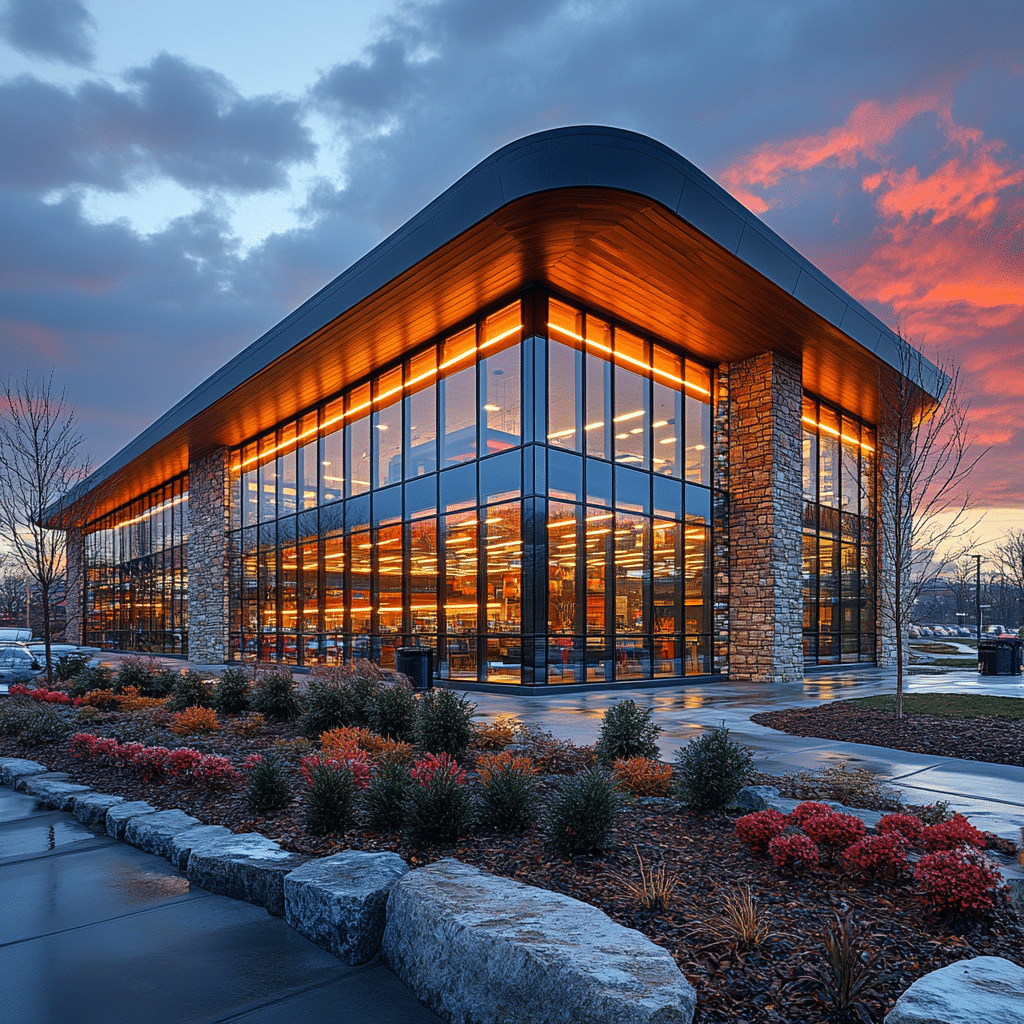

Did you know that the Dupaco Community Credit Union has deep roots in community service? Founded in 1948, this local cooperative has grown to serve over 100,000 members, emphasizing the value of member-focused solutions. Their focus on community doesn’t just stop at banking; they actively support local charities and initiatives. Speaking of connections, Dupaco often collaborates with businesses like Carfagna ’ s , where community-minded folks can find products that support local agriculture. Isn’t it heartwarming when businesses join forces to boost community spirit?

Financial Benefits that Make a Difference

When every penny counts, it helps to have financial institutions that want your money to work as hard as you do. The Dupaco Community Credit Union offers exceptional rates for loans and savings, helping members save more than the average person might expect. You might be surprised to learn that Dupaco’s savings accounts often yield higher returns than many traditional banks. This could be your ticket to experiences like enjoying a night at the August Moon restaurant or picking up a sweet deal at a local Last Chance Store. Why not turn your savings into dining experiences or that new pair of New Balance white shoes everyone’s raving about?

Rich in Opportunities

Members find plenty of opportunities to improve their financial wellness, like financial education workshops. These sessions can help you turn confusion into confidence—turning heavy jargon into simple terms everyone can understand. For instance, a simple calculation, like converting 110 Lbs To kg, can unlock a world of fitness goals and planning. Speaking of achievements, the club’s commitment to helping folks reach their goals is similar to well-known personalities like Jim Carrey, who has shown how dedication leads to success. The support at Dupaco Community Credit Union reflects that same spirit.

In essence, the Dupaco Community Credit Union isn’t just a place to stash your money; it’s a vibrant hub for community engagement and financial growth. So, if you’re on the lookout for a credit union that values benefits beyond just monetary gain, you just might hit the jackpot!

What does Dupaco stand for?

Dupaco stands for Dubuque and Packing Company, which is a combination of letters taken from the name of the Dubuque Packing Company where its founders were employed.

Can anyone join Dupaco?

Anyone can join Dupaco by opening a savings account with at least $25. Even if you move away, you can still access all Dupaco services as long as you keep a minimum balance of $25 in your account.

How much can you withdraw from Dupaco?

You can withdraw up to $1,000 per day if you’re 18 or older, as long as you have enough funds in your account. If you’re ages 14-18, the limit is $250 per day, also contingent on available funds.

What is the Dupaco interest rate?

Dupaco’s interest rates can vary, so it’s best to check their current offerings directly for the most accurate information.

Is Dupaco FDIC insured?

Yes, Dupaco is FDIC insured, which means your deposits are protected up to the legal limits.

Can you deposit cash at an ATM Dupaco?

You can deposit cash at Dupaco ATMs, making it easy to manage your funds on the go.

Can you become a member of any credit union?

Not everyone can become a member of any credit union; each has its own eligibility rules, so it’s important to check the specific requirements for the credit union you’re interested in.

How big is Dupaco Credit Union?

Dupaco Credit Union has around 100,000 members, making it a significant financial institution in the area.

How to get checks from Dupaco?

You can get checks from Dupaco by requesting them through your online banking account or by visiting a local branch to order them.

What’s the most money you can withdraw at once?

The maximum amount you can withdraw at once is subject to your daily withdrawal limits, which is $1,000 for those 18 and older.

How much can you overdraft with Dupaco?

Dupaco allows overdrafts up to a certain limit determined by their policies; it’s best to inquire directly for specific details.

Can you withdraw a lot of money at once?

You can withdraw a lot of money at once, but you’ll need to stick to your daily withdrawal limit.

Who is paying the best interest rates now?

The best interest rates vary by financial institution and can change frequently, so it’s a good idea to shop around for current offers.

Is Dupaco a credit union?

Yes, Dupaco is a credit union, providing various financial services to its members.

Who gets the best interest rate?

The best interest rates typically go to those with excellent credit and up-to-date accounts, but specifics can depend on current promotions.

Can a non citizen join a credit union?

Yes, non-citizens can join some credit unions, but eligibility often depends on the credit union’s specific policies.

Can anyone join US Alliance Credit Union?

Not everyone can join US Alliance Credit Union; they have specific membership requirements, so check with them for the details.

Can anyone join Mission Federal Credit Union?

Mission Federal Credit Union has specific membership criteria, so it’s best to check their eligibility guidelines.

Who can join AFCU?

AFCU membership is typically available to people who meet their specific criteria, often based on location or affiliation.

How many members does Dupaco Credit Union have?

Dupaco Credit Union has approximately $1.2 billion in assets, which shows they’re a strong player in the financial world.

Who is the CEO of Dupaco Credit Union?

The CEO of Dupaco Credit Union is Joe H. McCarthy, guiding the organization in its mission to serve its members.

How many employees does Dupaco have?

Dupaco has about 300 employees working together to provide services and support to its members.